A brighter tomorrow

Bitcoin transforms money.Tesla delivers sustainable abundance.

Harnessing the two pre-eminent disruptive assets of our time within a single treasury vehicle.

Launching soon.

Invest via Republic Europe (formerly Seedrs) to be part of the first Tesla-focused treasury company.

📖 About

TSLA Proxy is a UK startup building the world’s first dual-asset treasury combining Bitcoin and Tesla, the most transformative assets of the coming decade.Inspired by MicroStrategy’s model for Bitcoin and Smarter Web Company’s Aquis-listed Bitcoin strategy, we aim to use our balance sheet and capital markets access to accumulate Bitcoin and Tesla stock, amplify upside, and offer convertible bond and preference share investors an equity-like return with bond-like protection.Unlike traditional leveraged ETFs — which decay over time — our approach mirrors MicroStrategy’s use of convertible debt, preference shares, and at-the-market offerings (ATMs). These tools provide long-term leverage without daily resets, offering sustainable exposure to what we believe is the most asymmetric opportunity in the equity markets: Tesla.Our launch begins with a pre-IPO raise, Crowdcube funding and a planned listing on the Aquis Exchange, before targeting a Nasdaq uplisting in 2026 to access deep US capital markets and institutional convertible bond investors.

📊 Strategy

TSLA Proxy gives investors what the market doesn’t: leveraged exposure to Tesla and Bitcoin through a structure that works for bonds, options, and equity — all in one vehicle.Tesla hasn’t issued a corporate bond since 2019, when it raised $1.35B in convertibles at a 2% coupon. Since then, fixed-income investors have had no direct way to gain Tesla exposure through bonds.We change that.

1. Bond investors get Tesla and Bitcoin exposure — with protection and upside

Our convertible notes and preference shares offer bond investors something they can’t get anywhere else:- Downside protection

- Balanced risk across uncorrelated dual assets

- Ongoing yield

- Asymmetric upside tied to Tesla’s stock performanceThis taps into a huge pool of capital from funds restricted to bonds — creating immediate demand for our issuance.

2. Options traders get what they need: volatility

Tesla & Bitcoin already has some of the highest implied volatility in public markets. Our capital structure — using leverage from convertibles, preference shares, and ATM equity — amplifies that volatility, creating:- A premium to NAV

- High-volatility equity ideal for long/short options strategies

- An asset tailor-made for volatility-focused fundsIt’s volatility without decay — unlike ETFs like TSLL that suffer from reset drag and daily rebalancing.

3. Equity investors get clean, compounding, leveraged Tesla exposure

TSLA Proxy delivers what leveraged ETFs can't:- No daily reset decay

- No high fees

- Balanced risk across the two most transformative assets of the coming decade.

- A capital strategy that compounds over time

- *Smart treasury management - raise funds on up days via ATM and buy into either BTC or TSLA on dips or cycle lows.

- Avoids extreme volatility of BTC treasury co's that buy continuously then suffer extreme drawdowns and struggle to raise funds in bear markets.The more Tesla grows, the more capital we can raise, the more Tesla we can buy — a flywheel of NAV growth, capital inflow, and demand.

A Proven Model

We’re following a blueprint that’s already created billions in shareholder value:- MicroStrategy (MSTR) scaled from ~$1B in 2020 to over $100B using the same playbook with Bitcoin — turning treasury strategy into equity alpha.

- SmarterWebCompany (SWC) rocketed from a £2M crowdfunding round to over £600M market cap within two months of listing on the Aquis Growth Market in London.TSLA Proxy applies this model to Tesla, not crypto — targeting the largest, most liquid, most asymmetric opportunity in equities.> Some call it the Infinite Money Glitch.

> We call it smart capital management.

📈 Capital Raise & Shareholder Value

All capital raises are designed to be accretive — increasing the amount of Tesla & Bitcoin shares held per TSLA Proxy share over time.This ensures:Bondholders get protected income + Tesla & Bitcoin upsideOptions traders access amplified implied volatilityEquity investors gain smart, scalable leverage on Tesla — the most transformative company of our era

💡 The Infinite Money Glitch — Engineered for Bitcoin & Tesla

A 5-step flywheel that compounds Tesla & Bitcoin exposure and shareholder value.

1. Raise Capital

We issue convertible bonds, preferred shares, and equity (only when trading above NAV) to attract leveraged capital from fixed-income investors, traders, and long-term Tesla bulls.2. Acquire Bitcoin & Tesla Stock

Capital raised is used to accumulate TSLA as our core treasury asset — fully liquid, high-growth, and central to our value proposition.3. Apply Smart Leverage

We use our Bitcoin and TSLA holdings as collateral to raise low-interest capital, enabling non-decaying, sustainable leverage — unlike daily-reset ETFs.4. Amplify Returns

Bondholders earn interest plus upside through convertibility. Equity holders gain compounded exposure to Bitcoin and Tesla’s growth, enhanced by structural leverage — following MicroStrategy’s proven playbook.5. Grow & Repeat

As TSLA & bitcoin appreciates, we raise capital at higher valuations, acquire more stock, and repeat the cycle — compounding long-term value for all stakeholders.

🚀 Smarter Web Company case study

📈 21,393% increase in 56 days!

In April 2025, The Smarter Web Company (SWC) became the first publicly listed Bitcoin treasury company on the UK’s Aquis Exchange.In just 56 days, SWC’s stock price soared by an extraordinary +21,393%, fueled by its bold treasury strategy and growing investor demand for direct Bitcoin exposure via traditional capital markets.This explosive growth validated a powerful new capital markets playbook:

Treasury-backed public companies serving as high-leverage vehicles for conviction assets.At TSLA Proxy, we’re adopting the same capital model — but with Tesla, not Bitcoin. Like SWC and MicroStrategy before us, we use smart capital engineering to deliver scalable, sustainable, and leveraged exposure to one of the most disruptive companies of our time.

TSLA Proxy follows the Infinite Money Glitch model pioneered by MicroStrategy and now proven by SWC.We replicate this capital-efficient strategy by accumulating two high-conviction high growth treasury asset (Bitcoin & Tesla stock) and financing growth through convertible bonds, preferred shares, and equity issuance — creating a self-reinforcing loop of treasury appreciation, capital access, and value creation.Our roadmap includes a public listing on the UK’s Aquis Exchange in 2026, followed by a Nasdaq uplisting in 2028 — unlocking access to deep global equity and bond market liquidity.

🚀 Why Tesla?

Tesla isn’t just a car company — it’s the most asymmetric opportunity in global equity markets.

🤖 A new era of sustainable abundance for all: Why the TAM for Humanoid Labor Could Exceed $1 Quadrillion

Unlike traditional automation, humanoid robots like Tesla’s Optimus don’t just replace human labor — they expand the concept of labor itself. As costs of energy and AI decline toward near-zero, humanoid robots will enable an era of post-scarcity productivity. Labor will no longer be constrained by time, fatigue, or geography. This means the TAM for labor isn’t just $100 trillion/year (today’s wage bill) — it multiplies exponentially as every home, business, and individual gains access to near-infinite machine labor. Analysts like James Mullarney (InvestAnswers) and futurists aligned with ARK Invest suggest this could unlock a multi-quadrillion-dollar opportunity, as humanoid robots are deployed in billions of units — from personal assistants (your own C-3PO or R2-D2) to fully automated enterprises. In this future, Optimus isn’t just Tesla’s most important product — it may become the most valuable product in history.

📊 Investment Rationale

Explosive Growth: Tesla leads trillion-dollar sectors like EVs, self driving vehicles, AI, robotics, and energy. ARK Invest and others project a $5–10 trillion valuation by 2030–2035.🤖 Optimus: Tesla’s humanoid robot could replace vast amounts of human labor, working 24/7 across logistics, manufacturing, and services.🚕 Full Self-Driving (FSD): Tesla’s fleet may become a global robotaxi network, collapsing transport costs and capturing 50% of all miles driven.These shifts could make Tesla the most valuable company in history — a real-world platform for AI, robotics, and autonomy.

Unmatched Liquidity & Volatility:

💰 $1.05T market cap📈 80–100M daily trading volume📊 61–62% implied volatility

Outpaces Bitcoin ETFs, making TSLA more attractive for leveraged strategies.Bond Market Power: Tesla shares are liquid, high-grade collateral in the $128T global bond market — enabling convertible debt with built-in upside.Options Magnet: With 70–100% implied volatility, TSLA Proxy attracts long-term bulls and short-term traders alike.

Tesla Stock price predictions

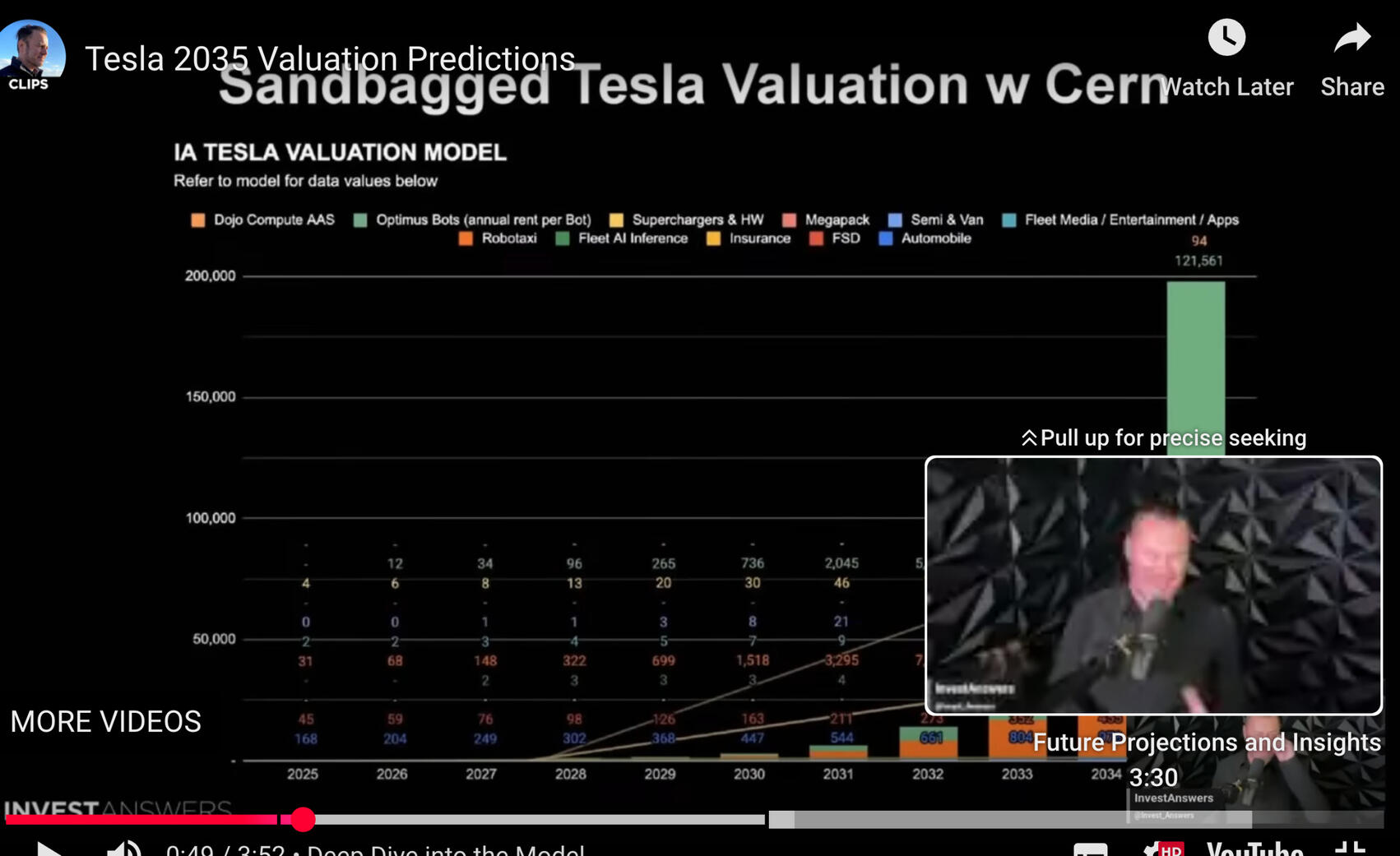

The $200,000 per share Tesla Thesis: InvestAnswers’ Bold Long-Term Model

James Mullarney, the creator of the popular YouTube channel InvestAnswers, has modeled an ultra-bullish long-term price target of $200,000 per Tesla share, representing a 600x increase from current levels. This theoretical scenario is based on Tesla’s full maturation as an AI-driven energy and robotics powerhouse — spanning autonomous vehicles, humanoid robots (Optimus), Dojo-as-a-service, and grid-scale energy storage. With over 540,000 subscribers and a background in quantitative finance, tech investing, and fund management, James blends macro analysis with deep modeling across disruptive tech. His credentials include 25+ years of experience in institutional investing and risk management, with a focus on exponential technologies. While his $200K target is a speculative scenario, it reflects a growing belief among high-conviction investors that Tesla’s long-term upside is vastly underpriced if it executes across all its verticals. At TSLA Proxy, we don’t dismiss bold outcomes — we position for them with smart, scalable capital engineering.

Tesla continues to attract bold price targets from some of the most respected names in finance. Tom Lee of Fundstrat has projected that Tesla could reach $1,200–$1,500 per share within the next 4–5 years, citing its disruptive potential in AI, robotics, and energy. Cathie Wood’s ARK Invest maintains one of the most ambitious outlooks, with a $2,600 base case and $3,500+ bull case for Tesla by 2029, driven by widespread FSD adoption and the scaling of Optimus humanoid robots. Analysts like Gary Black (Future Fund) and Pierre Ferragu (New Street Research) also forecast significant upside, anticipating continued margin expansion and market leadership across EV, software, and energy segments. Even traditionally conservative voices such as Dan Ives of Wedbush foresee Tesla surpassing $1,000 in the medium term as it unlocks new revenue streams. At TSLA Proxy, we share this high-conviction outlook — and structure our capital model to compound alongside it.

💼 Investor Benefits

One vehicle. Multiple ways to win.💵 For Fixed-Income Investors

- Access the upside of Tesla & Bitcoin while still earning interest / dividends- Bonds backed by high-value, liquid collateral (TSLA & BTC)- Structured downside protection with potential for capital appreciation📊 For Equity Investors

- Get leveraged exposure to Tesla & Bitcoin — without ETF decay & high fees- Compounding growth via MicroStrategy-style treasury model- Transparent capital strategy with Tesla & Bitcoin-per-share as the core metric

- Intelligent treasury buys. Dual asset strategy allows us to raise funds across uncorrelated assets and then time buys on dips or cycle lows. This is not possible with pure play BTC treasury co's that continuously buy and struggle to raise finance in bear markets.⚡ For Options Traders

- Higher implied volatility (70–100%) from leverage + structure- A tradable equity proxy with Tesla's movement amplified- Long and short opportunities around predictable capital events🧠 Why This Matters

Traditional ETFs can’t issue bonds. Hedge funds can’t offer liquid shares. Crypto lacks real cash flows.TSLA Proxy combines the strengths of all three — with a singular focus:Tesla, Bitcoin, long-term, leveraged, and sustainable.

Contact Us

Interested in becoming an early investor?

Get in on the ground floor — email us your details and we’ll be in touch.

✅ Thank you — message sent!

We’ve received your message and will get back to you shortly. In the meantime, feel free to explore our mission at TSLA Proxy.

✅ Please click button below to access our investor deck.